earn-money-trading.site

Overview

Best Retirement Savings Calculator

Free calculators that help with retirement planning with inflation, social security, life expectancy, and many more factors being taken into account. Use these free retirement calculators to determine how much to save for retirement, project savings, income, K, Roth IRA, and more. Our retirement calculator estimates your retirement savings based on your current contributions, and then calculates how your savings will stretch in today's. Use this version for a quick look at your retirement outlook. It's best for those who don't have a lot of different investments. Detailed Analysis — Create a balanced portfolio of investments with the help of the Investment Questionnaire. Retirement Savings Discover how a (k) can be one of your best tools. Use these handy online calculators to estimate your income needs in retirement and help establish your savings goals. Use this calculator to help you see where you stand in relation to your retirement goal and map out different paths to reach your target. earn-money-trading.site provides a FREE retirement income calculator and other fund calculators to help consumers make the best retirement planning decisions. earn-money-trading.site provides a FREE (k) calculator to help consumers calculate their retirement savings growth and earnings. Find more (k) calculators at. Free calculators that help with retirement planning with inflation, social security, life expectancy, and many more factors being taken into account. Use these free retirement calculators to determine how much to save for retirement, project savings, income, K, Roth IRA, and more. Our retirement calculator estimates your retirement savings based on your current contributions, and then calculates how your savings will stretch in today's. Use this version for a quick look at your retirement outlook. It's best for those who don't have a lot of different investments. Detailed Analysis — Create a balanced portfolio of investments with the help of the Investment Questionnaire. Retirement Savings Discover how a (k) can be one of your best tools. Use these handy online calculators to estimate your income needs in retirement and help establish your savings goals. Use this calculator to help you see where you stand in relation to your retirement goal and map out different paths to reach your target. earn-money-trading.site provides a FREE retirement income calculator and other fund calculators to help consumers make the best retirement planning decisions. earn-money-trading.site provides a FREE (k) calculator to help consumers calculate their retirement savings growth and earnings. Find more (k) calculators at.

A good savings target: 10% to start, gradually building to 15% or more. How much do you currently save for retirement each month (% of income). Whether you are looking for a retirement score or a retirement income calculator, Fidelity's retirement tools & calculators can help you plan for your. Use our Savings Calculator to determine how long your money will last and better predict your retirement. Learn how much retirement savings you may need compared to what you have and how you can adjust to any shortfalls. Our retirement calculator projects how long. This is the best retirement calculator on the Web. Model multiple post-retirement income streams. Try Financial Mentor's Ultimate Retirement Calculator now. Use this Retirement Savings calculator to see if you're on track for retirement. Estimate your retirement savings balance throughout your retirement. The rule of thumb is to have enough to draw down 80% to 90% of your pre-retirement income. Or, using a simple formula like saving 12 times your pre-retirement. Saving for retirement can be daunting. Use our retirement calculator to see good use of tax-advantaged savings plans such as (k)s and IRAs. The. Best retirement calculators? · Smart Assets Retirement Calculator which is the most in depth one I've found to date, but might be overkill for. Are you saving enough for retirement? Use our retirement calculator to calculate how much retirement savings you might need What is a good monthly retirement. Our retirement calculator and planner estimates monthly retirement income and efficient retirement savings spending, providing useful financial insights. Are you saving enough money for retirement? Use our retirement savings calculator to help find out how much money you need to save for retirement. Financial planning tools. Whether your priority is retirement, saving for college or both, Merrill has the tools to help you plan for the future. Use these handy online calculators to estimate your income needs in retirement and help establish your savings goals. Best Vanguard Mutual Funds to Buy · Home · retirement · retirement planning Are You Rich? Savings Calculator: Check How Much Your Money Will Grow. Get. The T. Rowe Price Retirement Income Calculator and MaxiFi Planner are two of the best tools. It is important to keep in mind that retirement calculators rely on. When is the best time to take Social Security? Explore different scenarios Calculate your future monthly retirement income in less than a minute. Retirement Savings Calculator. We know that retirement Everyone has different ideas about what an ideal retirement looks like, and how to best fund it. Basically saving like for FIRE but you started late so don't get to actually retire early. Upvote. Historically, the year return of the S&P has been roughly 10–12%. Calculate. Your Results. Estimated Retirement Savings. In 0 years.

Opening An Investment Account For A Minor

Here are some advantages to opening a brokerage account for your kids and the steps to follow to get them started on the right foot. Junior ISA. A Junior ISA can be set up by a parent or guardian, after which anyone can pay into it. The child can take control of. Best Investment Account for Kids: 5 Options · 1. Custodial Roth IRA · 2. Education Savings Plans · 3. Coverdell Education Savings Accounts · 4. UGMA/UTMA. Some banks may require children to reach a certain age before opening an account, while others have no age restrictions. Many experts believe that by the age of. Child eligibility, For children aged 13 to 17, a parent/guardian with an existing Fidelity account may open this account on their behalf. Child must have the. With a custodial account (aka Kids Portfolio at Stash), you can buy stocks and ETFs on behalf of the children in your life—and the money is theirs when they. The Schwab One Custodial Account is a brokerage account that allows you to make a financial gift to a minor and help teach them about investing. Investment accounts created to benefit your children are referred to as custodial brokerage accounts. Similar to traditional brokerage accounts, you can use. Best investment accounts for kids · Teen-owned brokerage account · college savings plan · Coverdell education savings account · Custodial Roth IRA · UGMA or UTMA. Here are some advantages to opening a brokerage account for your kids and the steps to follow to get them started on the right foot. Junior ISA. A Junior ISA can be set up by a parent or guardian, after which anyone can pay into it. The child can take control of. Best Investment Account for Kids: 5 Options · 1. Custodial Roth IRA · 2. Education Savings Plans · 3. Coverdell Education Savings Accounts · 4. UGMA/UTMA. Some banks may require children to reach a certain age before opening an account, while others have no age restrictions. Many experts believe that by the age of. Child eligibility, For children aged 13 to 17, a parent/guardian with an existing Fidelity account may open this account on their behalf. Child must have the. With a custodial account (aka Kids Portfolio at Stash), you can buy stocks and ETFs on behalf of the children in your life—and the money is theirs when they. The Schwab One Custodial Account is a brokerage account that allows you to make a financial gift to a minor and help teach them about investing. Investment accounts created to benefit your children are referred to as custodial brokerage accounts. Similar to traditional brokerage accounts, you can use. Best investment accounts for kids · Teen-owned brokerage account · college savings plan · Coverdell education savings account · Custodial Roth IRA · UGMA or UTMA.

A custodial account is a means by which an adult can open a savings or brokerage account for a child. The adult who opens the account is responsible for. Our execution-only minor investment account is designed as an efficient way for adults who are comfortable making their own investment decisions without advice. Please note, you must be at least 18 years old to open any investment account. Custodial accounts are for minors (under the age of 18) that have assets. Research and Choose an ETF: Start by researching and selecting an Exchange-Traded Fund (ETF) that aligns with your investment goals and risk. Basically, these are easy-to-open accounts used to invest in stocks, bonds, mutual funds, and more—all to give a child a better future. A great way to get kids interested and involved in investing is to open an investment account. Here are a couple of appropriate account types. A custodial account can be an excellent way to make a financial gift to a child—whether your own, a relative's, or a friend's. You have options when it comes to investing for a child or a minor. Learn more about what Vanguard UGMA/UTMA custodial accounts have to offer. They can be used to save for any goal and, like regular brokerage accounts, dividends and capital gains are taxable. The minor can take ownership of the account. Begin your child's investment future with a UGMA custodial account. Start for as little as $1/day. Open an account today in just 5 minutes! Open a account, with you as the owner and the kid as the beneficiary. You need the kid's SS, name, and date of birth. The account belongs to. If you want to give a minor a gift of investments or cash, opening a custodial account may be one solution. A custodial account is managed by a custodian on. Acorns Early is our investment account for kids that can come with potential tax benefits. If you are in the Gold plan, Acorns Early is built into your. Custodial accounts let parents, grandparents, and others invest funds for a minor. The accounts offer potential tax benefits and the flexibility to use funds. Best for education: savings plan A savings plan offers key tax incentives to start saving for your children's education. As long as you use the money. Looking to invest in the future of the child or children in your life? Stash offers a type of investment account geared specifically towards children under. Sukanya Samriddhi Yojana This one is another government-backed investment account for kids, specifically designed for a girl child. This savings account earns. A Minor Trust Account must be opened by an adult, who can be a parent, guardian, grandparent or other family member over 18 years of age. A child cannot create. A custodial Roth IRA is a smart consideration for forward-looking individuals, as it enables kids to start saving for their golden years as soon as they start. Learn how to open a custodial account to invest on behalf of a minor (Member SIPC), offers investment services and products, including Schwab brokerage.

Salary Needed For 400k House

Likes, Comments. TikTok video from Freddie Smith (@fmsmith): “Calculate the income required to afford a k house with a 7%. Suppose your household annual income is $, If you have good credit and no other debt, the 43% DTI rule means a mortgage lender will assume you can. To afford a $, house, borrowers need $55, in cash to put 10 percent down. With a year mortgage, your monthly income should be at least $ and. What are some common DTI requirements? Mortgage lenders use DTI to ensure you're not being over extended with your new loan. Experts recommend having a DTI. That means you'd need to earn about $10, a month, or $, per year, in order to afford a $, home. Your actual take-home pay will depend on your. To afford a $, house, for example, you need about $55, in cash if you put 10% down. With a % year mortgage, your monthly income should be at. you need to determine how much house you can afford. One way to start is to get pre-approved by a lender, who will look at factors such as your income, debt. The debt-to-income ratio (DTI) is your minimum monthly debt divided by your gross monthly income. The lower your DTI, the more you can borrow and the more. Use this home affordability calculator to get an estimate of the home price you can afford based upon your income, debt profile and down payment. Likes, Comments. TikTok video from Freddie Smith (@fmsmith): “Calculate the income required to afford a k house with a 7%. Suppose your household annual income is $, If you have good credit and no other debt, the 43% DTI rule means a mortgage lender will assume you can. To afford a $, house, borrowers need $55, in cash to put 10 percent down. With a year mortgage, your monthly income should be at least $ and. What are some common DTI requirements? Mortgage lenders use DTI to ensure you're not being over extended with your new loan. Experts recommend having a DTI. That means you'd need to earn about $10, a month, or $, per year, in order to afford a $, home. Your actual take-home pay will depend on your. To afford a $, house, for example, you need about $55, in cash if you put 10% down. With a % year mortgage, your monthly income should be at. you need to determine how much house you can afford. One way to start is to get pre-approved by a lender, who will look at factors such as your income, debt. The debt-to-income ratio (DTI) is your minimum monthly debt divided by your gross monthly income. The lower your DTI, the more you can borrow and the more. Use this home affordability calculator to get an estimate of the home price you can afford based upon your income, debt profile and down payment.

If you are looking to borrow £,, you would need a salary of at least £57, to be eligible for a loan of this size. Of course, this is just a guideline. A mortgage on k salary, using the rule, means you could afford $, ($,00 x ). With a percent interest rate and a year term, your. Regardless, k is high income. You are just choosing to spend it all on housing. You may not be rich, but k is definitely high income. Hell, k is high. “The average monthly payment for a $, home is $3,,” says Walsh. “That's based on the typical first-time homebuyer down payment of 7%. Your gross income should be around $6, per month or $78, per year in order for you to comfortably afford the house. This way the monthly. To afford a $, house, borrowers need $55, in cash to put 10 percent down. With a year mortgage, your monthly income should be at least $ and. How much You Need to make to buy a $, home? Your down payment of % is going to be $14, Principle and interest at a rate of 6% is and $ Once. Income Requirements · Mortgage Qualification. +; Save Money · Extra This pre qualification calculator estimates the minimum required income for a house. Mortgage Research Center features mortgage news and advice for homebuyers from a team of experts in mortgage, real estate and personal finance. Under $80, Where can I Afford to Live in Houston? $80, to $, Best Neighborhoods; $, to $, Cost of Luxury Homes; Over $, Most. income for your household. Then take your annual income and divide by 12 to Documents needed for mortgage application. Here are a few documents you. And in this case, your gross annual income would need to be $, to $, “The real question is how much house payment you want to take on,” says Kammer. income ratio you need to qualify for a home purchase. Your other two options, pay off debt and increase income, take time. Perhaps you need to make a budget. Lenders will look at your salary when determining how much house you can Mortgage Lenders determine the underwriting criteria necessary for. To afford a house that costs $, with a down payment of $70,, you'd need to earn $75, per year before tax. The mortgage payment would be $1, /. How much do you need to make to be able to afford a house that costs $,? To afford a house that costs $, with a down payment of $80,, you'd. Lenders need to see evidence that your income is both stable and sufficient enough to cover the cost of a mortgage. You can show proof of income using a letter. Can I buy a house if I make 60k a year? It is certainly feasible to purchase a home with a salary of $60, per year. Low–down–payment loans and down payment. Learning about lenders' mortgage requirements can help you determine which homes are realistic options for you. How much house can I afford based on my salary. This does not include upfront mortgage insurance if needed. Your salary must meet the following two conditions on FHA loans: - The sum of the monthly mortgage.

Credit Building For Bad Credit

1. Get all your accounts current 2. Pay everything when due on time 3. Any credit card balances above 70% of limit, pay down, then below 50%. Very Poor. Car Insurance. Learn More. $/mo. $/mo. Student Loan I knew I was building credit but was amazed that it was so high. I have. How to improve your credit before applying for a credit card · Pay down current credit card debt. · Open a credit-builder loan and make on-time monthly payments. Pay your bills on time. All the time. · Credit cards have a minimum payment due every month. · Don't max out your cards — keep your credit utilization low (under. While having a good credit score is key to being able to get loans and approvals, there are many people with poor credit. This can be due to any number of. Actions like paying your utility bill on time or keeping a low credit card balance can positively influence your credit. Similarly, missing payments or racking. You can fix a bad credit score by paying bills on time, keeping credit card balances low and using credit-strengthening products like secured credit cards. Simply put, Credit Builder is the fast-track way to building or rebuilding your credit. Customize Your Credit Builder Loan. Your Credit Builder Loan can be. The Mission Lane Visa® Credit Card could be a reasonable option for someone building or rebuilding credit who doesn't want to tie up money in a security deposit. 1. Get all your accounts current 2. Pay everything when due on time 3. Any credit card balances above 70% of limit, pay down, then below 50%. Very Poor. Car Insurance. Learn More. $/mo. $/mo. Student Loan I knew I was building credit but was amazed that it was so high. I have. How to improve your credit before applying for a credit card · Pay down current credit card debt. · Open a credit-builder loan and make on-time monthly payments. Pay your bills on time. All the time. · Credit cards have a minimum payment due every month. · Don't max out your cards — keep your credit utilization low (under. While having a good credit score is key to being able to get loans and approvals, there are many people with poor credit. This can be due to any number of. Actions like paying your utility bill on time or keeping a low credit card balance can positively influence your credit. Similarly, missing payments or racking. You can fix a bad credit score by paying bills on time, keeping credit card balances low and using credit-strengthening products like secured credit cards. Simply put, Credit Builder is the fast-track way to building or rebuilding your credit. Customize Your Credit Builder Loan. Your Credit Builder Loan can be. The Mission Lane Visa® Credit Card could be a reasonable option for someone building or rebuilding credit who doesn't want to tie up money in a security deposit.

Combined credit builder account and secured card products to help you build credit and save* money (minus interest and fees) No credit check. · No credit check. Take a loan out, maybe 5k, and pay it back in installments. This will extend your credit line and show you make payments on time. You can even. In general, good credit makes you more likely to receive funding at good rates, while bad credit could lead to rejecting loan and credit applications, and, if. If you want to improve your score by making small, relatively low-maintenance monthly payments, Kikoff can help you. Kikoff is a company that offers a credit. Start with a Credit Builder Account* that reports to all 3 credit bureaus. Each on-time monthly payment builds credit history and savings. Typically they are most useful for someone with bad credit. Someone with no credit, can usually get an okay starter credit card, and get their. The best credit cards for bad credit are secured cards with no annual fee. That's true for everyone with poor credit, except people who need a modest emergency. Credit Builder Loan Take out a small loan and make monthly payments to establish credit or boost your low credit score. Unlike traditional credit cards, Credit Builder is a secured card that helps you build credit history with no annual fees and no interest. There's also no. It can take about 6 to 9 months to establish credit from scratch. Show lenders your creditworthiness and keep the momentum going by learning more about taking. Compare top credit cards for bad credit. Establish or build your credit. Don't settle for a bad card with steep fees. We offer a loan to help you raise your credit score over time. We won't deny you because of your low credit score, but you must be a member in good standing. 9 ways to help rebuild credit · 1. Review your credit reports · 2. Pay your bills on time · 3. Catch up on overdue bills · 4. Become an authorized user · 5. Consider. A credit builder loan from Genisys is designed for anyone that has less-than-stellar credit as a means to help rebuild their financial standing. This program is designed to help people build or establish credit. You're given a fixed rate loan, and the proceeds go into a Certificate of Deposit savings. Credit cards to help build or rebuild credit can create a brighter financial future when handled responsibly. Altura's Credit Builder Loan is designed for Members seeking to rebuild and increase their credit score, helps establish your credit history while increasing. The Self Credit Builder Account can be a first step in establishing credit from scratch. If you have bad credit or a low credit score, the Credit Builder. Six tips help improve your credit Expand · Keep track of your progress. · Always pay bills on time. · Keep credit balances low. · Keep unused accounts open. · Be. Compare the Best Credit Builder Loans ; Credit Karma Best for No Interest Charged, N/A ; Credit Strong Best for Long Repayment Terms, %–% ; Digital.

Uphold Lawsuit

Because the United Nations has immunity from local jurisdiction and cannot be sued in a national court, the Organization has set up an internal justice system. Oceana, the Center for Biological Diversity, and Turtle Island Restoration Network demand in the lawsuit that NMFS comply with the federal law requiring the. Companies)—initiated a lawsuit against Uphold.2 The lawsuit alleges that Uphold represented that it intended to universalize the process of trading. complaint to HLC. HLC does not review the outcomes of institutional grievance processes to either uphold or overturn those decisions. In no case will the. [PDF] Wal-Mart Sex Discrimination Class Action Plaintiffs Urge Supreme Court To Uphold Historic Civil Rights and Workers' Laws in Brief Filed Today · Part of the. Whether we are filing a class action, a lawsuit on behalf of an Uphold Rights of Students with Disabilities · Nursing Services Cases. Canon 1: A Judge Should Uphold the Integrity and Independence of the Judiciary Canon 2: A Judge Should Avoid Impropriety and the Appearance of Impropriety. uphold the laws that keep Hoosiers safe. To file a complaint with the If evidence is found to suggest the complaint has merit, the Attorney General then. Ethical responsibilities of judges: · comply with federal and state laws · uphold the law impartially · perform judicial duties without bias, prejudice or. Because the United Nations has immunity from local jurisdiction and cannot be sued in a national court, the Organization has set up an internal justice system. Oceana, the Center for Biological Diversity, and Turtle Island Restoration Network demand in the lawsuit that NMFS comply with the federal law requiring the. Companies)—initiated a lawsuit against Uphold.2 The lawsuit alleges that Uphold represented that it intended to universalize the process of trading. complaint to HLC. HLC does not review the outcomes of institutional grievance processes to either uphold or overturn those decisions. In no case will the. [PDF] Wal-Mart Sex Discrimination Class Action Plaintiffs Urge Supreme Court To Uphold Historic Civil Rights and Workers' Laws in Brief Filed Today · Part of the. Whether we are filing a class action, a lawsuit on behalf of an Uphold Rights of Students with Disabilities · Nursing Services Cases. Canon 1: A Judge Should Uphold the Integrity and Independence of the Judiciary Canon 2: A Judge Should Avoid Impropriety and the Appearance of Impropriety. uphold the laws that keep Hoosiers safe. To file a complaint with the If evidence is found to suggest the complaint has merit, the Attorney General then. Ethical responsibilities of judges: · comply with federal and state laws · uphold the law impartially · perform judicial duties without bias, prejudice or.

uphold Catholic values. But in , one of its substitute teachers sued the Diocese after he lost his position for publicly advocating against Catholic. From litigation, to policy advocacy, to educating federal and state lawmakers, NCYL is working to create a robust landscape of legal protections for. A Dutch environmental group, the Urgenda Foundation, and Dutch citizens sued the Dutch government to require it to do more to prevent global climate change. lawsuit - A legal action started by a plaintiff against a defendant based uphold - The decision of an appellate court not to reverse a lower court. They will steal your coins,!freeze your account with a 'under review message.' Then wipe your account clean. Uphold is a scam. A class action. American Alliance for Equal Rights (AAER) files lawsuit against Fearless Fund and Fearless Foundation (full lawsuit). court to uphold the September 26 ruling. All members of the Oregon State Bar promise to uphold the law and to comply If you have a complaint against someone licensed in another state. His lawsuit targeted what the federal government calls the “SAVE” Plan I took a similar oath to uphold the Constitution when I was sworn in as. SALT LAKE CITY—Today, NetChoice updated the complaint in our lawsuit against Ninth Circuit Should Uphold Preliminary Injunction in Alario v. Knudsen. May. A coalition of immigration advocacy groups sued over the rule along with other legal services organizations. In both lawsuits, the plaintiffs had asked the. American Alliance for Equal Rights (AAER) files lawsuit against Fearless Fund and Fearless Foundation (full lawsuit). court to uphold the September 26 ruling. Whether we are filing a class action, a lawsuit on behalf of an Uphold Rights of Students with Disabilities · Nursing Services Cases. His lawsuit targeted what the federal government calls the “SAVE” Plan I took a similar oath to uphold the Constitution when I was sworn in as. Upon taking office, he swore to uphold the Constitution and uphold our democracy. Throughout the presidential election, Donald Trump enacted a plan to. AG Paxton leads state brief supporting Trump administration lawsuit against California to uphold immigration law and protect public safety. "I will defend our rights, uphold the rule of law, and serve the people of Oklahoma. lawsuit settlement. Aug 28, No Data. View More. Latest Opinions. AG. Complaint Form to allege that a CEO or a BSI has materially failed to uphold their code enforcement duties as a CEO or BSI. (These items are described in Brackeen is the lawsuit brought The Campaign works to inform policy, legal, and communications strategies with the mission to uphold and protect ICWA. 6 in a lawsuit challenging its provision of in-state tuition at state colleges and universities to undocumented immigrants who have attended at least three. Court of Ohio and must maintain that license in good standing. As a condition of admission to practice, attorneys also must swear to uphold the Constitution.

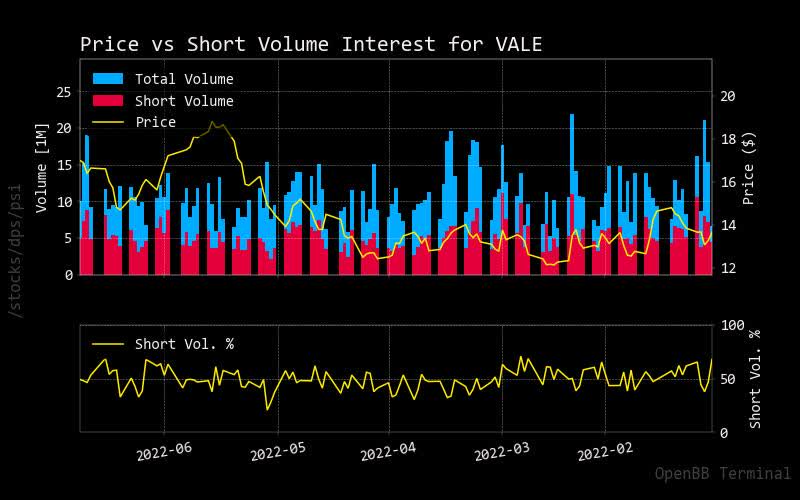

Stock Short Volume

Daily short volumes only cover off-exchange short sale transactions, the data does not represent a comprehensive view into short-selling activity for the. It is calculated by dividing the number of shares sold short by the average daily trading volume, generally over the last 30 trading days. The ratio is used by. Key Points. A stock that rallies hyperbolically when there are no obvious current events driving the response, could be experiencing a short squeeze. High short-interest ratio: The short-interest ratio of a stock is calculated by dividing the stock's current short interest by its average daily trading volume. Koyfin gives the inside skinny on short interest stocks with high potential in volatile markets. Visualize & analyze short interest charts. The Daily Short Sale Volume Files reflect the aggregate number of shares executed on the Nasdaq market during regular trading hours. At the security level. Short Volume Ratio This is the total number of short shares sold divided by the total shares traded in a given day. Each FINRA member firm is required to report its “total” short interest positions in all customer and proprietary accounts in Nasdaq-listed securities twice a. The short interest ratio is calculated by dividing the total number of short positions by the company's average daily trading volume (ADTV) under consideration. Daily short volumes only cover off-exchange short sale transactions, the data does not represent a comprehensive view into short-selling activity for the. It is calculated by dividing the number of shares sold short by the average daily trading volume, generally over the last 30 trading days. The ratio is used by. Key Points. A stock that rallies hyperbolically when there are no obvious current events driving the response, could be experiencing a short squeeze. High short-interest ratio: The short-interest ratio of a stock is calculated by dividing the stock's current short interest by its average daily trading volume. Koyfin gives the inside skinny on short interest stocks with high potential in volatile markets. Visualize & analyze short interest charts. The Daily Short Sale Volume Files reflect the aggregate number of shares executed on the Nasdaq market during regular trading hours. At the security level. Short Volume Ratio This is the total number of short shares sold divided by the total shares traded in a given day. Each FINRA member firm is required to report its “total” short interest positions in all customer and proprietary accounts in Nasdaq-listed securities twice a. The short interest ratio is calculated by dividing the total number of short positions by the company's average daily trading volume (ADTV) under consideration.

short selling volume information for individual equity securities. The SROs NASDAQ (includes The Nasdaq Stock Market, Nasdaq BX and Nasdaq PSX markets). Short interest, stock short squeeze, short interest ratio & short selling data positions for NASDAQ, NYSE & AMEX stocks to find shorts in the stock market. Today's Short Volume is 8,,, which is % of today's total reported volume. Over the past 30 days, the average Short Volume has been %. Regardless of which definition is used, the basic principle is the same: a stock or index with a high short interest ratio has a high number of shares sold. For data beyond days, you can download a Daily Short Sale Transaction File, a Monthly Short Sale Volume File, or use our Query API. Daily volume and trade reports of short sale activity on Cboe U.S. Equity exchanges (BYX, BZX, EDGA, EDGX). Most Shorted Stocks ; BYND. Beyond Meat, Inc. ; MPW. Medical Properties Trust, Inc. ; GNLN. Greenlane Holdings, Inc. ; SAVA. When expressed as a percentage, short interest is the number of shorted shares divided by the number of shares outstanding. For example, a stock with Short interest indicates how many shares of stock remain short or are sold short and haven't been covered yet. It's important to know what it means to short. The short interest ratio is a mathematical indicator of the average number of days it takes for short sellers to repurchase borrowed securities in the open. If a stock split occurs before the settlement date, the Short Interest and Average Daily Share volume will be adjusted based on that stock split. is currently not trading. Many investors believe that rising short interest positions in a stock is a bearish indicator. They use the Days to Cover statistic. Nasdaq short interest is available by issue for a rolling 12 months and updated twice a month. Short Interest data is based on a mid-month and end of month. High Short Interest Stocks ; SOUN, SoundHound AI Inc, Nasdaq, %, M ; SPCE, Virgin Galactic Holdings Inc, NYSE, %, M. Cboe makes available, without charge, a summary of consolidated market short interest positions in all Cboe-listed securities. Short volume in stock refers to the number of shares that have been sold short by investors during a particular period of time, typically over a period of a. The short interest ratio is another name for the short interest data when presented in the form of a percentage. It is calculated by taking the entire number of. Short interest refers to the number of shares sold short but not yet repurchased or covered. Watchlist by Yahoo Finance. Find the list of top stocks with the highest short interest. Discover stocks you may want to trade and invest in. The NYSE Group Short Interest File is a semi-monthly file containing the reported uncovered short positions of securities listed on NYSE, NYSE Arca and NYSE.

Dow Jones Close Yesterday

Yesterday; Today; Tomorrow; This Week; Next Week. No Events Scheduled. Show Dow notches record. The closing price for the Dow Jones Industrial Average (DJI) on September 16, was $ 22 minutes ago. The Dow peaked on Jan. 14, , closing at 11,, thanks to the boom in internet businesses.7 It was the end of. Dow Jones - Top Gainers ; Travelers, , ; Intel, , ; American Express, , ; IBM, The Dow Jones reached 40, yesterday. 40, what? · Investing money held between the time premiums are paid and healthcare costs are generated. Dow Jones Industrial Average ; Day Range 41, - 41, ; 52 Week Range 32, - 41, ; 5 Day. % ; 1 Month. % ; 3 Month. %. Dow Jones Industrial Average · Price (USD)41, · Today's Change / % · Shares tradedm · 1 Year change+% · 52 week range32, - 41, Dow Jones Industrial Average (^DJI). Follow. 41, + (+%). As of Previous Close 41,; Open 41,; Volume 96,,; Day's Range. Yesterday; Today; Tomorrow; This Week; Next Week. No Events Scheduled. Show Dow notches record. The closing price for the Dow Jones Industrial Average (DJI) on September 16, was $ 22 minutes ago. The Dow peaked on Jan. 14, , closing at 11,, thanks to the boom in internet businesses.7 It was the end of. Dow Jones - Top Gainers ; Travelers, , ; Intel, , ; American Express, , ; IBM, The Dow Jones reached 40, yesterday. 40, what? · Investing money held between the time premiums are paid and healthcare costs are generated. Dow Jones Industrial Average ; Day Range 41, - 41, ; 52 Week Range 32, - 41, ; 5 Day. % ; 1 Month. % ; 3 Month. %. Dow Jones Industrial Average · Price (USD)41, · Today's Change / % · Shares tradedm · 1 Year change+% · 52 week range32, - 41, Dow Jones Industrial Average (^DJI). Follow. 41, + (+%). As of Previous Close 41,; Open 41,; Volume 96,,; Day's Range.

Dow Jones Industrial Average (DJI) ; Prev. Close: 41, ; Open: 41, ; 1-Year Change: % ; Volume: ,, ; Average Vol. (3m): ,, Each market will close early at pm ( pm for eligible options) on Wednesday, July 3, , and Thursday, July 3, The Dow Jones U.S. Total Stock Market Index, a member of the Dow Jones Close. OK. Cookie Settings. Your Privacy. Strictly Necessary Cookies. Performance. US stock market Friday: S&P , Dow Jones, Nasdaq near record highs, Nvidia share price rises per cent. S&P , Dow Jones Industrial Average, and. 26 minutes ago. Nasdaq, S&P, Dow close with gains as odds pop up for a large Fed rate cut. Sep. 13, PM ETDow Jones Industrial Yesterday, PM. Comments (K). For this analysis, we considered the end of a bull market when the index drops below its peak and stays there for a significant period of time. Performance. Dow Jones Industrial Average (DJI) ; 41, +(+%). Closed 13/09 ; Day's Range. 41, 41, 52 wk Range. 32, 41, Each market will close early at pm ( pm for eligible options) on Wednesday, July 3, , and Thursday, July 3, Dow Jones publishes the world's most trusted business news and financial information in a variety of media. It delivers breaking news, exclusive insights. Dow Jones Industrial Average ; Price (USD)41, ; Today's Change / % ; Shares tradedm ; 1 Year change+% ; 52 week range32, - 41, Each point of the stock market graph is represented by the daily closing price for the DJIA. Historical data can be downloaded via the red button on the upper. The most recent DJIA closing value in this data set is on September 13, The History of the Dow Index. Stock market holidays are non-weekend business days when the two major U.S. stock exchanges, the New York Stock Exchange (NYSE) and the Nasdaq are closed. Units: Index, Not Seasonally Adjusted. Frequency: Daily, Close. Notes: The observations for the Dow Jones Industrial Average represent the daily index value. The observations for the Dow Jones Industrial Average represent the daily index value at market close. The market typically closes at 4 PM ET, except for. Find the latest Dow Jones Industrial Average, ^DJI stock market data. Get a full understanding of how Dow Jones Industrial Average is CLOSE. CLOSE. close of trading. This list automatically updates in real Indices have staged a rebound after their wobble in the wake of yesterday's US inflatio. The Dow Jones Industrial Average rallied points, or %, to finish at 39,, while the S&P gained % to close at 5, and punched above. Latest Close; Latest Month-End; Risk; Correlation. Export. Compare. SPICE. As of Sep 12, Index Level. 1 Day. MTD. QTD. YTD. Dow Jones Industrial Average.

Best Out Of Pocket Insurance

Some health insurance plans call this an out-of-pocket limit. A plan year is Top. I want to Get an ID card · File a claim · View my claims and EOBs. Access to great care from Minnesota's #1 health plan. Individual and Your out-of-pocket costs will be lower when your doctor, clinic and hospital. Best Overall: Blue Cross Blue Shield Blue Cross Blue Shield offers the best cost overall, with especially good pricing for Silver plans and people over Copays are fixed amounts (such as $10 or $20) that you pay out-of-pocket for visits to in-network healthcare providers. health insurance plan that's the best. premium even if your out-of-pocket maximum is reached. back to top. 4. What is a provider network? A provider network is a specific set of doctors, nurses. Best cash-out refinance lendersBest HELOC Lenders Look at the plan's deductible — how much you must pay out of pocket before the plan starts to pay a portion. Policies with lower monthly premiums seem like a better deal, but a lower monthly premium could mean you'll have less coverage or that you'll pay more out-of-. Copays are fixed amounts (such as $10 or $20) that you pay out-of-pocket for visits to in-network healthcare providers. health insurance plan that's the best. top of your premiums during a policy period for deductibles, coinsurance and copays. Once you reach your out-of-pocket maximum, your health insurance will. Some health insurance plans call this an out-of-pocket limit. A plan year is Top. I want to Get an ID card · File a claim · View my claims and EOBs. Access to great care from Minnesota's #1 health plan. Individual and Your out-of-pocket costs will be lower when your doctor, clinic and hospital. Best Overall: Blue Cross Blue Shield Blue Cross Blue Shield offers the best cost overall, with especially good pricing for Silver plans and people over Copays are fixed amounts (such as $10 or $20) that you pay out-of-pocket for visits to in-network healthcare providers. health insurance plan that's the best. premium even if your out-of-pocket maximum is reached. back to top. 4. What is a provider network? A provider network is a specific set of doctors, nurses. Best cash-out refinance lendersBest HELOC Lenders Look at the plan's deductible — how much you must pay out of pocket before the plan starts to pay a portion. Policies with lower monthly premiums seem like a better deal, but a lower monthly premium could mean you'll have less coverage or that you'll pay more out-of-. Copays are fixed amounts (such as $10 or $20) that you pay out-of-pocket for visits to in-network healthcare providers. health insurance plan that's the best. top of your premiums during a policy period for deductibles, coinsurance and copays. Once you reach your out-of-pocket maximum, your health insurance will.

There's no yearly limit on what you pay out-of-pocket, unless you have supplemental coverage – like. Medicare Supplement Insurance (Medigap). Medicare. Once you reach your policy's out-of-pocket maximum, insurance will cover good health — since it could mean fewer unexpected visits to the doctor. Medicaid · Child Health Plus · Essential Plan · Private Insurance/Qualified Health Plans · Family Planning Benefit Program · Family Planning Extension Program. Health insurance plans for individuals and families living outside of their home country. Aetna International. Aetna Passport to Healthcare. Anthem (Bupa). Best. An out-of-pocket maximum is a cap on your cost sharing for a year. Once your cost share amounts reach the out-of-pocket maximum, the plan pays % of the. insurance plan pays you directly if you're diagnosed with a covered critical illness — helping you pay for out-of-pocket expenses. Your insurer typically. Prefer to have lower out-of-pocket costs but a higher monthly bill We have different plan levels at different costs to best meet your health and budget needs. get the most out of your benefits. ON-SCREEN TEXT: [How a health plan Your health plan offers you further protection with an out-of-pocket limit. good faith estimate, your bill, and information from your health care provider or health insurance chooses to pay their health care costs out of pocket. Health Insurance Options · Premier Preferred Provider Organization, or PPO Higher premiums, but lower out-of-pocket costs for your deductible, copays and. Understanding Out-of-Pocket Maximums · Your insurance premiums · Anything you spend for services your plan doesn't cover · Out-of-network care and services · Costs. The monthly premiums you pay in order to have coverage are not included in out-of-pocket costs. Out-of-pocket costs are only incurred if and when you need. Covered California Bronze. Icon of Stethoscope. Premiums LOWEST. Out-of-Pocket HIGHEST. 60% coverage. Lower monthly premium if you qualify for financial help. This tool is designed to help you estimate your premium and out-of-pocket (OOP) costs for health insurance in a given year. And it can be hard to choose the best insurance. Most policies are required to cover certain preventive health benefits without any out-of-pocket cost to you. When shopping for health insurance, you should consider: how much medical care you will need,; the total health care costs including out-of-pocket costs. Premium, co-pay, deductible, co-insurance, and out-of-pocket maximum. Premium A network is a list of doctors and hospitals that you have to use to get the. 1. Review your plan online · 2. Know your out-of-pocket maximum · 3. Save your support team's contact information · 4. Choose an in-network doctor · 5. Make a plan. Stick with PPO plans, which will at least give you coverage for doctors that are out of network. Also, make sure that your out-of-pocket max is. Stick with PPO plans, which will at least give you coverage for doctors that are out of network. Also, make sure that your out-of-pocket max is.

How To Bet A Stock Will Go Down

It's a bet that the price of the stock will go down. Here's a simple example to illustrate: · Suppose I own a share of stock that's currently. Nvidia Earnings Blow Past Expectations, but Don't Lift Shares · Nasdaq Falls % as Stock Market Wobbles · Salesforce Financial Chief Will Step Down · Super Micro. Short selling is a trading strategy where investors speculate on a stock's decline. Short sellers bet on, and profit from a drop in a security's price. Find the latest stock market trends and activity today. Compare key indexes, including Nasdaq Composite, Nasdaq, Dow Jones Industrial & more. Now it's going down faster than a Thai hooker on an american tourist. 50b Stock could be delisted (again) if they're both cooking the books, AND. If you bet £5 per point that Apple stock will go up, then you'll earn £5 for If it had moved down 50 points, you would lose £ Spread betting. The simplest way to bet against a stock is to buy put options. To review, buying a put option gives you the right to sell a given stock at a certain price by a. If the asset's price goes down, the put increases in value. On the other hand, if it rises, the value of the put option decreases, which (in this case) is in. How to bet on the stock market going down? You can short sell stocks or buy and sell different types of options credit and debit spreads. It's a bet that the price of the stock will go down. Here's a simple example to illustrate: · Suppose I own a share of stock that's currently. Nvidia Earnings Blow Past Expectations, but Don't Lift Shares · Nasdaq Falls % as Stock Market Wobbles · Salesforce Financial Chief Will Step Down · Super Micro. Short selling is a trading strategy where investors speculate on a stock's decline. Short sellers bet on, and profit from a drop in a security's price. Find the latest stock market trends and activity today. Compare key indexes, including Nasdaq Composite, Nasdaq, Dow Jones Industrial & more. Now it's going down faster than a Thai hooker on an american tourist. 50b Stock could be delisted (again) if they're both cooking the books, AND. If you bet £5 per point that Apple stock will go up, then you'll earn £5 for If it had moved down 50 points, you would lose £ Spread betting. The simplest way to bet against a stock is to buy put options. To review, buying a put option gives you the right to sell a given stock at a certain price by a. If the asset's price goes down, the put increases in value. On the other hand, if it rises, the value of the put option decreases, which (in this case) is in. How to bet on the stock market going down? You can short sell stocks or buy and sell different types of options credit and debit spreads.

The put option buyer is betting on the fact that the stock price will go down (by the time expiry approaches). Hence in order to profit from this view, he. Conversely, if you expect the share or commodity to fall in value, you would take a short position (sell). How spread betting works: what is a spread bet stake? Get the latest Canadian business news, TSX updates, interest rates and Bank of Canada coverage. Explore stock market investing and get expert financial. This means they have a “long” position and expect the stock to go up. These traders will profit when the stock moves up, or will lose money when the stock moves. Short selling is the act of betting against a stock by selling borrowed shares and then repurchasing them at a lower cost and returning them later. HP returns to growth, but stock falls as profit comes up short. Provided by Salesforce's stock gains as margin outlook gets a boost; CFO to step down. Tell you where the stock price will go · Predict the direction of the movement · Be an infallible solution of stock movement (war, natural disasters, adverse news. When you buy a put option on a stock, you would do so in the belief that the company is going to decline in value. Buying a put gives you the right to sell. With the Fed ready to start cutting interest rates, smaller stocks could take the lead. Long read. Why the Chip Maker's Stock Is Down Despite Posting Strong. It's what investors do when they think the price of a stock will go down. With short selling, it's about leverage. Investors sell stocks they've borrowed from a. You will exercise your options and get a profit. Yay! 2. If the price of the stock moves down, you got a bailout. Since this was an option, you. How to Bet Against the Stock Market Going Down: [4] Buy Inverse ETFs [3] Buy A Put Option on SPY or DIA [2] Short the Market [1] Sell Bearish Credit. If the asset's price goes down, the put increases in value. On the other hand, if it rises, the value of the put option decreases, which (in this case) is in. – Shorting stocks in the spot market · When you short a stock what is the expected directional move? The expectation is that the stock price would decline. In doing so, you'll realize any profits or losses associated with the trade. If you sell your option for more than your purchase price, you'll profit. If you. For example, if you write a put option, then you are hoping that the stock price will continue to trade flat, go up or trade sideways. If you sell a call option. Say, the investor is now convinced the stock will rally instead, and decides to purchase the stock outright before it goes any higher. Unless the investor is. A 2% change in the share price would be a £2 change if you were holding £ of shares in the stock market, but with this particular example of a spread bet. One potential signal could be when a stock has fallen through a series of lower lows while trading at higher volumes. Another could be when a stock has. Make sure you can articulate a prospective stock's "story line"-the company's plans for increasing growth and any other series of events that will help the firm.

Best Car Loan Rates 2021

The average car loan interest rate in is around 4% for new cars and 8% for used cars based on the Experian data above. A good interest rate will be at or. At CCU, we have some of the best auto loan rates, and we'll work with you APR - to **. 0 - 60 months, %, %. 61 - 72 months, %, In , I got a 3 yr old used car at % interest, 6yr loan with a total interest of about $1k over the life of the loan. Financed though. New and Used Auto, Auto Lease Buy-outs, and Motorcycle Loans · 4 Year Auto Loans · 5 Year Auto Loans · 6 Year Auto Loans. Today's rates. · New Auto/Motorcycle Loans | Model Year and Newer | New/Refinance · Used Auto/Motorcycle Loans | Model Year * · General Secured |. Interest accrues during the day deferral period. Auto Refinance Rates. Effective Date: 08/07/ for vehicle model years Navy Federal offers competitive auto loan rates for new and used vehicles. See how much money you could save on new or used car financing today. For model years or newer with greater than 48, miles see Used Auto Model Years - rates. Good things are happening at SRP. Copyright. Average Auto Loan Rates in July ; Average Auto Loan Rates for Excellent Credit · or higher, %, %, % ; Average Auto Loan Rates for Good Credit. The average car loan interest rate in is around 4% for new cars and 8% for used cars based on the Experian data above. A good interest rate will be at or. At CCU, we have some of the best auto loan rates, and we'll work with you APR - to **. 0 - 60 months, %, %. 61 - 72 months, %, In , I got a 3 yr old used car at % interest, 6yr loan with a total interest of about $1k over the life of the loan. Financed though. New and Used Auto, Auto Lease Buy-outs, and Motorcycle Loans · 4 Year Auto Loans · 5 Year Auto Loans · 6 Year Auto Loans. Today's rates. · New Auto/Motorcycle Loans | Model Year and Newer | New/Refinance · Used Auto/Motorcycle Loans | Model Year * · General Secured |. Interest accrues during the day deferral period. Auto Refinance Rates. Effective Date: 08/07/ for vehicle model years Navy Federal offers competitive auto loan rates for new and used vehicles. See how much money you could save on new or used car financing today. For model years or newer with greater than 48, miles see Used Auto Model Years - rates. Good things are happening at SRP. Copyright. Average Auto Loan Rates in July ; Average Auto Loan Rates for Excellent Credit · or higher, %, %, % ; Average Auto Loan Rates for Good Credit.

Used , mos, $8,, %, 90% LTV. mos, $10,, %, 90 ABA Best Credit Unions to Work For. Image. top 10 credit unions. Image. Commuter. Auto Loan Rates - Model Year · 36 Months, %, $ 48 Months ; Auto Loan Rates - Model Year · 48 Months, %, $ 60 Months ; Auto. Auto Loan Rates ; Annual Percentage Rates (As Low As*) ; Model Year, Terms Up To 48 Months, Terms Up To 66 Months ; New Auto , %, % ; Used Auto. Apply for auto financing today. The rate calculator provides estimated auto financing terms, APRs and monthly payment amounts. Current state of auto loan interest rates ; Superprime: %. %. ; Prime: %. %. ; Nonprime: %. %. ; Subprime: Auto Loan Rates ; - Used, 66 , % ; - Used, 48 , % ; - Used, 12 - 48, % ; & Older (Specialty Collateral), Up to. That puts average monthly car payments at $, $ and $, respectively. The price of used cars and trucks decreased. Used car and truck prices are down a. Auto Loan Rates - Model Year · 36 Months, %, $ 48 Months ; Auto Loan Rates - Model Year · 48 Months, %, $ 60 Months ; Auto. The average interest rate for auto loans on new cars is %. The average interest rate on loans for used cars is %. What credit score is needed to buy a. Loan Rates ; Cash Out Refinances and Classic Cars, Contact Credit Union, 12 to 60 Months, %, 60 monthly payments of $ per $1, financed at % APR. Average New Car Interest Rates ; Nov , %, % ; Aug , %, % ; May , %, % ; Feb , %, %. Loan Rates ; CONVENTIONAL AUTO LOAN MODEL YEARS: & NEWER ; 3 Year (36 Month), %, $ ; 5 Year (60 Month), %, $ ; 6 Year (72 month)**, %. * Rates “as low as” % APR assumes excellent creditworthiness; your rate may differ from the rate(s) shown here. Rate and loan amount subject to credit. & Newer Vehicle Rates ; 24 Month · % · $ per $1, ; 36 Month · % · $ per $1, ; 48 Month · % · $ per $1, ; 63 Month · % · $ How Do You Get the Best Car Finance Rate? As you can see from the above numbers, the best rates for an auto loan can vary significantly, depending on your. Explore car loan rates ; New/Used Cars, and newer models, Up to 63 months, As low as % ; New/Used Cars, and newer models, 64 to 75 months, As low as. & Older Vehicles. rates as low as. %. APR*. Boats The branch manager was extremely helpful in getting me the best auto loan for my dream truck. New or Used Vehicle Loans ; Model Years and Newer · Minimum Financing of $25, for 84 Months · % ; Model Years · Minimum Financing of $25, New Auto ( / untitled ), Up to 60 months, as low as % ; Used Auto ( to ), Up to 72 months, as low as % ; Used Auto ( to ), Up to. Use our widget to find auto loan rates, select your state to view your auto loan rates To ensure you receive the best service possible, please enter your zip.

2 3 4 5 6 7