earn-money-trading.site

Prices

Way Point Resource Group

Bluebook · - Jones v. Waypoint Resource Group, LLC · Category · Collection · SuDoc Class Number · Court Type · Court Name · Circuit · Office Location. The Waypoint Group can help you achieve your financial goals. Learn about Retirement, Investing, Family, Business Planning, Philanthropy, and Mosaic. Waypoint Resource Group is a legitimate company. They aren't fake or trying to scam you. But it is likely they are spam calling you trying to collect a debt. *Each team will coordinate, arrange site visit if needed, recruit team members, plan with Waypoint staff to secure resources, and arrange travel/meals in Goliad. Here at Waypoint Home Group, we want to provide that meeting place where you can meet friendly faces to help you navigate coming to a new country and partner. Waypoint Resource Group, LLC (WRG) is a third-party collection agency based in Texas. WRG has received consumer complaints alleging violations of the Fair Debt. Learn about popular job titles at Waypoint Resource Group · Call Center Representative · Collection Agent · Collector · Customer Service Representative. WAYPOINT RESOURCE GROUP is a trademark of WAYPOINT RESOURCE GROUP, LLC. Filed in July 30 (), the WAYPOINT RESOURCE GROUP covers Accounts receivable. Get more information for Waypoint Resource Group in Round Rock, TX. See reviews, map, get the address, and find directions. Bluebook · - Jones v. Waypoint Resource Group, LLC · Category · Collection · SuDoc Class Number · Court Type · Court Name · Circuit · Office Location. The Waypoint Group can help you achieve your financial goals. Learn about Retirement, Investing, Family, Business Planning, Philanthropy, and Mosaic. Waypoint Resource Group is a legitimate company. They aren't fake or trying to scam you. But it is likely they are spam calling you trying to collect a debt. *Each team will coordinate, arrange site visit if needed, recruit team members, plan with Waypoint staff to secure resources, and arrange travel/meals in Goliad. Here at Waypoint Home Group, we want to provide that meeting place where you can meet friendly faces to help you navigate coming to a new country and partner. Waypoint Resource Group, LLC (WRG) is a third-party collection agency based in Texas. WRG has received consumer complaints alleging violations of the Fair Debt. Learn about popular job titles at Waypoint Resource Group · Call Center Representative · Collection Agent · Collector · Customer Service Representative. WAYPOINT RESOURCE GROUP is a trademark of WAYPOINT RESOURCE GROUP, LLC. Filed in July 30 (), the WAYPOINT RESOURCE GROUP covers Accounts receivable. Get more information for Waypoint Resource Group in Round Rock, TX. See reviews, map, get the address, and find directions.

Waypoint Resource Group leverages nearly four decades of customer engagement experience to provide businesses and credit lenders a better way of accounts. Sundance Pkwy Round Rock, TX earn-money-trading.site Related Listings XpertDox XpertCoding is an autonomous medical coding solution. Waypoint is a transitional home for women recovering from substance use disorder. We offer a safe, stable environment for women to continue their recovery. Searching for a trusted Helena Realtor? KW Waypoint Realty Group is equipped with 25+ years of expertise in local residential and commercial real estate. Absolutely, Waypoint Resource Group functions as a debt collector. They acquire unsettled debts from creditors who have given up on collecting those amounts. RESOURCES. The following documents are designed to help our producers Provides quarterly updates on producer company GWP and hit ratio performance. Reviews from Waypoint Resource Group employees about working as a Collection Agent at Waypoint Resource Group. Learn about Waypoint Resource Group culture. Verify Waypoint Resource Group employees. Let Truework help you complete employment and income verifications faster. The process is simple, automated. Waypoint Resource Group has an overall rating of out of 5, based on over 17 reviews left anonymously by employees. 34% of employees would recommend working. Find out what works well at Waypoint Resource Group from the people who know best. Get the inside scoop on jobs, salaries, top office locations. Waypoint Resource Group. 55 followers. . 1 following. Waypoint Resource Group provides accounts receivable management solutions across a variety of industries. Waypoint Resource Group. 53 kunna að meta þetta. Waypoint Resource Group provides accounts receivable management solutions across a variety of industries. Find useful insights on Waypoint Resource Group's company details, tech stack, news alerts, competitors and more. Use 6sense to connect with top. Sundance Pkwy Round Rock, TX earn-money-trading.site Related Listings XpertDox XpertCoding is an autonomous medical coding solution. Waypoint Resource Group provides accounts receivable management and revenue cycle management solutions across a variety of industries. group adventures, as most have limited available space.. Help Us Help Do you have a skill set, profession or resources that could be. We'll work with you and your team of professionals to create, implement and RELATED RESOURCES. Medical Professionals: A Prescription for Your. Waypoint Resource Group is a provider of accounts receivable management solutions. It offers payment, recovery accounts, skip tracing and bankruptcy aid. Gary Dorman (Director of Operations) | Sam Crawford (Program Manager) | View more for Waypoint Resource Group >>>.

Ample Battery

Ample batteries are designed to be a drop-in replacement for an electric vehicle's original battery. This is made possible by Ample's modular batteries, which. Ample utilizes autonomous robotics and smart-battery technology to solve the energy delivery challenge for electric transportation. It created an economical. We aim to solve the energy delivery challenge for electric transportation by utilizing autonomous robotics and smart-battery technology. Ample is a new energy delivery solution for electric vehicles. It uses Modular Battery Swapping to deliver % charge to any EV in a few minutes. Ample, which is a battery swapping startup, has partnered with Fisker to enable Fisker customers to swap batteries using Ample swap stations. For the charge of its electrical vehicles, Stellantis has established a partnership with Ample to use its exchange technology of battery modules. Ample focuses on energy delivery solutions for electric vehicles. The company offers a modular battery swapping system to enable a full charge to any electric. By utilizing autonomous robotics and smart-battery technology, Ample has created an economical and widely accessible platform that can fully charge any electric. Ample, which is a battery swapping startup, has partnered with Fisker to enable Fisker customers to swap batteries using Ample swap. Ample batteries are designed to be a drop-in replacement for an electric vehicle's original battery. This is made possible by Ample's modular batteries, which. Ample utilizes autonomous robotics and smart-battery technology to solve the energy delivery challenge for electric transportation. It created an economical. We aim to solve the energy delivery challenge for electric transportation by utilizing autonomous robotics and smart-battery technology. Ample is a new energy delivery solution for electric vehicles. It uses Modular Battery Swapping to deliver % charge to any EV in a few minutes. Ample, which is a battery swapping startup, has partnered with Fisker to enable Fisker customers to swap batteries using Ample swap stations. For the charge of its electrical vehicles, Stellantis has established a partnership with Ample to use its exchange technology of battery modules. Ample focuses on energy delivery solutions for electric vehicles. The company offers a modular battery swapping system to enable a full charge to any electric. By utilizing autonomous robotics and smart-battery technology, Ample has created an economical and widely accessible platform that can fully charge any electric. Ample, which is a battery swapping startup, has partnered with Fisker to enable Fisker customers to swap batteries using Ample swap.

Ample: unleashing the opportunity in battery swapping. 13 December , UTC 1 min read. Share: RouteZero Heroes is all about showcasing milestone. Description. Developer of an autonomous robotics technology designed to offer electric car battery swapping technology. The company's technology offers to solve. Stellantis and Ample are partnering to bring battery swapping to Europe, a possible addition to the growing infrastructure for servicing EV batteries. Ample focuses on energy delivery solutions for electric vehicles. The company offers a modular battery swapping system to enable a full charge to any electric. Stellantis and Ample are partnering to bring battery swapping to Europe, a possible addition to the growing infrastructure for servicing EV batteries. Battery swapping specialist Ample raises $ million in Series C funding. Posted August 30, by Charles Morris & filed under Fleets and Infrastructure. Ample is accelerating the transition to electric mobility through modular battery swapping, a universal EV charging solution in which depleted batteries are. [email protected]; California Ave. Suite C Bakersfield CA, Our Services. Solar Services · Roofing · Battery Storage. Quick Links. About Us. Video of Ample showing modular batteries for the Leaf!: Can EV Battery Swapping Take Off In The U.S.? EV battery swap specialist Ample has announced it is bringing the first-ever modular swap stations to Japan with the help of partner ENEOS. Ample utilizes autonomous robotics and smart-battery technology to solve the energy delivery challenge for electric transportation. It created an economical. Thanks to our modular approach to battery swapping, we can help customers to customize an electric vehicle's battery capacity based on each. Patent number: · Abstract: An apparatus for electrically and mechanically coupling battery modules to an electric vehicle includes an interface plate. Ample is a modular battery swapping solution that provides energy to electric vehicle fleets. Their innovative approach accelerates EV adoption by offering. Announcing Ample Modular Battery Swapping for Stellantis EVs. K views. 8 months ago · · Ample: A Whole New Electrifying Experience. 37K views. 1 year. Ample utilizes autonomous robotics and smart-battery technology to help deliver energy efficient electronic transportation. Buy or sell Ample stock Learn more. We aim to solve the energy delivery challenge for electric transportation by utilizing autonomous robotics and smart-battery technology. Mitsubishi Fuso is starting a battery swap demonstration for electric trucks on public roads in Japan this month. The courier service Yamato Transport will test. Electric vehicle battery startup Ample raises $ million. Reuters. Why battery swapping may finally become a part of EV charging infrastructure in the U.S.

How Hard Is It To Get A House Loan

Some basic requirements for getting a home loan include income, employment, a credit score, tax returns, and other documentation that all mortgage lenders need. Note that some government-backed mortgages, like FHA and VA loans, have strict property requirements that make it difficult to close on a fixer-upper. Take. The banks want to know you can afford both unforeseen expenses AND the mortgage, which is why it's so hard to get approval. They don't want you. Buying a second home may seem difficult, but if you know what to expect and review your finances, it could be easier than you think. Keep these factors in mind. Yes. There is not a specific minimum income to qualify for a mortgage and there are various loan types and programs designed to help eligible buyers cover a. If you have bad credit, it can be hard to qualify for a loan. However, if you have good income, there may be options for you if you want to buy a home. How to. Get a copy of your credit report and make sure it's error free. Clear up any issues you find before you apply for a mortgage. You can boost your credit score by. Conventional mortgages are popular options for those with good credit. They generally have fewer restrictions than government-backed loans, but they're not the. If you have a credit score lower than , you might find getting a mortgage a bit difficult and will probably need to focus on increasing your score first. Can. Some basic requirements for getting a home loan include income, employment, a credit score, tax returns, and other documentation that all mortgage lenders need. Note that some government-backed mortgages, like FHA and VA loans, have strict property requirements that make it difficult to close on a fixer-upper. Take. The banks want to know you can afford both unforeseen expenses AND the mortgage, which is why it's so hard to get approval. They don't want you. Buying a second home may seem difficult, but if you know what to expect and review your finances, it could be easier than you think. Keep these factors in mind. Yes. There is not a specific minimum income to qualify for a mortgage and there are various loan types and programs designed to help eligible buyers cover a. If you have bad credit, it can be hard to qualify for a loan. However, if you have good income, there may be options for you if you want to buy a home. How to. Get a copy of your credit report and make sure it's error free. Clear up any issues you find before you apply for a mortgage. You can boost your credit score by. Conventional mortgages are popular options for those with good credit. They generally have fewer restrictions than government-backed loans, but they're not the. If you have a credit score lower than , you might find getting a mortgage a bit difficult and will probably need to focus on increasing your score first. Can.

To get pre-approved, you will start by submitting a mortgage application. A loan officer will look at your credit history, income, assets, debts, etc. The. Texas FHA loans have long been a popular product among home buyers in Houston, and across the state. What makes the FHA loan so attractive is the low down. Thankfully, getting a home loan is not one of them — not directly, anyway. Most banks do not run criminal record checks before approving loans, and they are. You must have an acceptable credit history with a minimum credit score of and generally, you should plan to use no more than 30 - 33 percent (30 %) of. There is no minimum credit score requirement. Debt-to-income ratio. Homeowners have a more generous 65% DTI ratio, compared with the 45% maximum that comes with. Attempting to get a home loan with bad credit can be an extended process. It is important to remember that while the FHA and Freddie Mac or Fannie Mae may. Your debt payment history is the most influential factor in your credit score, and late payments can make it difficult to get approved for a mortgage. Even if. It's hard to get a mortgage nowadays. The lending market is incredibly tight and only borrowers with the best credit are getting the best rates. When you are planning on purchasing a home, the first thing you should do is apply for a mortgage loan With lenders other than banks, it's hard to tell. A. Explore down payments as low as 3% down. · Where should we start? · Calculate your mortgage payment. As a matter of course, lenders look at your credit report and credit score. Regardless of the lender, the higher your credit score, the better the financing. So. You'll need to prove that your home-building project is real, viable, and relatively low-risk for the lender. For most construction loan applications, you'll. Yes, you can get a construction loan for substantial renovations. Keep in mind that you'll typically need to show the lender that you'll be adding value to the. Explore down payments as low as 3% down. · Where should we start? · Calculate your mortgage payment. Unfortunately, getting a home loan is difficult for individuals without full-time jobs, even those with consistent income, because they're self-employed. Since. Your credit score is a deciding factor with a mortgage qualification, and it also helps determine the interest rate that you receive. The higher your score, the. With a low down payment, mortgage insurance will be required, which increases the cost of the loan and will increase your monthly payment. Talk with a home. Remember that whenever you apply for a loan, including a mortgage, the “hard inquiry” the lenders make shows up on your credit report and temporarily lowers. With a low down payment, mortgage insurance will be required, which increases the cost of the loan and will increase your monthly payment. Talk with a home. Unfortunately, getting a home loan is difficult for individuals without full-time jobs, even those with consistent income, because they're self-employed. Since.

How Can I Invest My Hsa Money

Sign in to your HSA and set up your investment account by choosing the self-directed mutual funds option from the investment options page. Choose the funds you. HSA funds can be directed towards and invested in several common assets, including stocks, bonds, ETFs, and mutual funds. How do I invest my HSA funds? · Log into HSA Central. · Choose View Investments from the I Want To section. · Start investing, view fund options and. Check with your broker-dealer for details. TD AMERITRADE ARRANGEMENT FOR STERLING ACCOUNTHOLDERS. Through Sterling, accountholders can choose to open a self-. When your balance reaches the minimum balance set by your HSA Administrator (typically $1,), you have the option to invest your HSA funds into the UMB HSA. Invest Your HSA Savings Investing your HSA allows you to be better prepared for future healthcare and retirement expenses. Your invested HSA funds grow tax. Three investment options — Choice, Select and Managed — give you thoughtfully chosen securities that are aligned to your HSA and relevant to your financial. Maximize your savings by investing Investing HSA dollars has many potential tax benefits and can be an additional way to save for long-term health care. Most HSAs require you to maintain a minimum cash balance before you can open an investment account. Once you have sufficient funds to meet your minimum and. Sign in to your HSA and set up your investment account by choosing the self-directed mutual funds option from the investment options page. Choose the funds you. HSA funds can be directed towards and invested in several common assets, including stocks, bonds, ETFs, and mutual funds. How do I invest my HSA funds? · Log into HSA Central. · Choose View Investments from the I Want To section. · Start investing, view fund options and. Check with your broker-dealer for details. TD AMERITRADE ARRANGEMENT FOR STERLING ACCOUNTHOLDERS. Through Sterling, accountholders can choose to open a self-. When your balance reaches the minimum balance set by your HSA Administrator (typically $1,), you have the option to invest your HSA funds into the UMB HSA. Invest Your HSA Savings Investing your HSA allows you to be better prepared for future healthcare and retirement expenses. Your invested HSA funds grow tax. Three investment options — Choice, Select and Managed — give you thoughtfully chosen securities that are aligned to your HSA and relevant to your financial. Maximize your savings by investing Investing HSA dollars has many potential tax benefits and can be an additional way to save for long-term health care. Most HSAs require you to maintain a minimum cash balance before you can open an investment account. Once you have sufficient funds to meet your minimum and.

You can choose to invest the money you contribute to your HSA in one or more of the following mutual funds. To learn about specific fund companies, please visit. How will I know how much of the money in my KeyBank HSA is available to be invested in a KIS HSA. Members can invest HSA dollars in the investment options offered by BenefitWallet and pay no federal taxes on any interest and/or investment earnings, as long. You can invest a portion of your Health Savings Account (HSA) balance in mutual funds and reap the benefits of investing while saving for future medical. Optum Bank mutual funds investments · Sign in to your HSA and set up your investment account by choosing the funds you want to invest in. · Indicate the amount. Some HSAs allow you to invest any funds in your HSA once you meet a minimum cash amount, enabling you to potentially earn more on that money. Can I invest the money in my HSA? Is my HSA FDIC-insured? Can I roll the Similar to an IRA, many HSAs let you choose to invest your account balance. My HSA allows it to be invested. It is in a fund. I have to keep 2K in cash, and it will auto invest 1K when I get over 3K in cash. How Large Could Your Account Grow? · You start your HSA account at age 26 · You make the maximum family coverage contribution every year until age 65, including. Investing your HSA funds can be a great way to save for the future. But it's generally only a good option if you're not consistently dipping into the account. Use your HSA as an investment vehicle in addition to other tax-advantaged accounts, such as a (k) and individual retirement accounts (IRAs). Automatic investing. To set up automatic investing on the member website, you will need to define your investment threshold and select the mutual funds that you. If you have an HSA, you may or may not be aware that you can invest a portion of your balance once it reaches a specific cash threshold*. HSA investment can be a useful tool for individuals looking to save money on healthcare costs and potentially earn long-term growth with significant tax. Invest your HSA from day 1! Lively has no minimum balance required to start investing. Manage your invested HSA funds entirely online. Your first option is investing your HSA dollars in self-directed mutual funds. You can choose from a wide variety of over 30 mutual funds including life stage. 7. What are my investment choices? It varies. Some HSAs function as savings accounts only, while others allow you to invest your contributions in a selection of. The funds in an HSA can be used to pay for qualified medical expenses that are not covered by your health plan, and can be saved for future expenses on a pre-. Invest your HSA from day 1! Lively has no minimum balance required to start investing. Manage your invested HSA funds entirely online. The balance in your HSA Investment Account is subject to investment risks, including fluctuations in value and the possible loss of.

Popular Metaverse

Listed below are the top crypto coins and tokens used for Metaverse. They are listed in size by market capitalization. To reorder the list, simply click on one. The metaverse games you should try: Illuvium, Revomon, Star Atlas, CyberTrade, the Sandbox, Alien Worlds, Fortnite, Roblox. Best Metaverse platforms · 1. Hyperverse · 2. The Sandbox · 3. Epic Games · 4. Roblox · 5. Star Atlas · 6. Decentraland · 7. Cryptovoxels · 8. Bloktopia. Top Metaverse Coins by Market Cap ; Dark Frontiers. DARK ; , RMV. Reality Metaverse. RMV ; , MVI. Metaverse Index. MVI. Category · 10 Metaverse Apps that Have Pioneered the VR Space · 1. Horizon Worlds · 2. Horizon Venues · 3. AltspaceVR · 4. Rec Room · 5. VR Chat · 6. The. Person in metaverse wearing Meta Quest Pro headset. Virtual reality Some of Nigeria's top creators are already using Meta technologies to create. The best one for those who want to create from within the platform, hands down, is Horizon Worlds. It is far far from perfect and it is the. Top metaverse companies May 15, Callum Moates. What is the metaverse? The metaverse is a massively scaled and interoperable digital universe. Discover the most popular Metaverse platforms! Immerse yourself in virtual worlds, experience innovative technologies and explore how digital realities are. Listed below are the top crypto coins and tokens used for Metaverse. They are listed in size by market capitalization. To reorder the list, simply click on one. The metaverse games you should try: Illuvium, Revomon, Star Atlas, CyberTrade, the Sandbox, Alien Worlds, Fortnite, Roblox. Best Metaverse platforms · 1. Hyperverse · 2. The Sandbox · 3. Epic Games · 4. Roblox · 5. Star Atlas · 6. Decentraland · 7. Cryptovoxels · 8. Bloktopia. Top Metaverse Coins by Market Cap ; Dark Frontiers. DARK ; , RMV. Reality Metaverse. RMV ; , MVI. Metaverse Index. MVI. Category · 10 Metaverse Apps that Have Pioneered the VR Space · 1. Horizon Worlds · 2. Horizon Venues · 3. AltspaceVR · 4. Rec Room · 5. VR Chat · 6. The. Person in metaverse wearing Meta Quest Pro headset. Virtual reality Some of Nigeria's top creators are already using Meta technologies to create. The best one for those who want to create from within the platform, hands down, is Horizon Worlds. It is far far from perfect and it is the. Top metaverse companies May 15, Callum Moates. What is the metaverse? The metaverse is a massively scaled and interoperable digital universe. Discover the most popular Metaverse platforms! Immerse yourself in virtual worlds, experience innovative technologies and explore how digital realities are.

Interested? Here are the top 15 Metaverse Startups to watch out in · 1. PlayersOnly · 2. Enjin · 3. The Sandbox · 4. Zepeto · 5. Axie Infinity · 6. Zash. List of Best Metaverse Companies · Meta (FB) · Microsoft (MSFT) · Nvidia (NVDA) · Roblox (RBLX) · Unity Software Inc (U) · Decentraland · Adobe (ADBE). Top 10 Metaverse Projects to watch out in · 1. Decentraland (MANA) · 2. The Sandbox (SAND) · 3. Axie Infinity (AXS) · 4. GALA (GALA) · 5. Metahero (HERO). What is a metaverse, and what are some metaverse examples? This article lists top crypto metaverse games, metaverse tokens, and related blockchain projects. Explore the first decentralized metaverse that is built, governed, and owned by its users. Discover different districts, meet people, party at events. Category · 10 Metaverse Apps that Have Pioneered the VR Space · 1. Horizon Worlds · 2. Horizon Venues · 3. AltspaceVR · 4. Rec Room · 5. VR Chat · 6. The. The 10 Best Examples Of The Metaverse Everyone Should Know About · Ready Player One · Second Life · Meta Horizons (Facebook) · Fortnite. 10 metaverse stocks to watch · Roblox · Nvidia · Meta platforms · Unity software · Microsoft · Snap · Sea · Amazon; Apple; Autodesk. We've selected our stocks. Samsung entered the metaverse with the Samsung X experience: a digital version of its pop-up New York store, built to showcase the products and other. Explore the first decentralized metaverse that is built, governed, and owned by its users Places. Browse locations in Genesis City & Worlds · My Favorite. Popular games described as part of the metaverse include Habbo Hotel, World of Warcraft, Minecraft, Fortnite, VRChat, and game. Consumers and Metaverse users · million individuals are actively participating in the Metaverse. · Roblox stands as the most expansive virtual Metaverse world. Top Metaverse Companies. Epic Games; Google; Meta; Microsoft; NVIDIA; Roblox; The Sandbox; Unity. In the years since Facebook announced its pivot to all things. Top 10 Metaverse Platforms in · 1. Decentraland (MANA) · 2. The Sandbox (SAND) · 3. AXIE INFINITY (AXS) · 4. GALA · 5. Enjin Coin (ENJ) · 6. Metahero (HERO). Top Metaverse Companies (22) · Roblox · ShapesXR · Juego Studio Pvt. Ltd. · Antier Solutions · Antier Solutions · Immersive Display Solutions, Inc. Investing in Metaverse Stocks · 1. Meta · 2. Roblox · 3. Microsoft · 4. Unity · 5. Cloudflare. Top Metaverse Development Companies in · 1. LeewayHertz · 2. Metavesal · 3. Spatial · 4. Decentraland · 5. Aetsoft. Visit. Best Metaverse platforms · 1. Hyperverse · 2. The Sandbox · 3. Epic Games · 4. Roblox · 5. Star Atlas · 6. Decentraland · 7. Cryptovoxels · 8. Bloktopia. Roblox, Fortnite and Minecraft are in the top 5 favorite cross-platform video games of the U18 segment. Brand experiences in Metaverse. Immersive experiences.

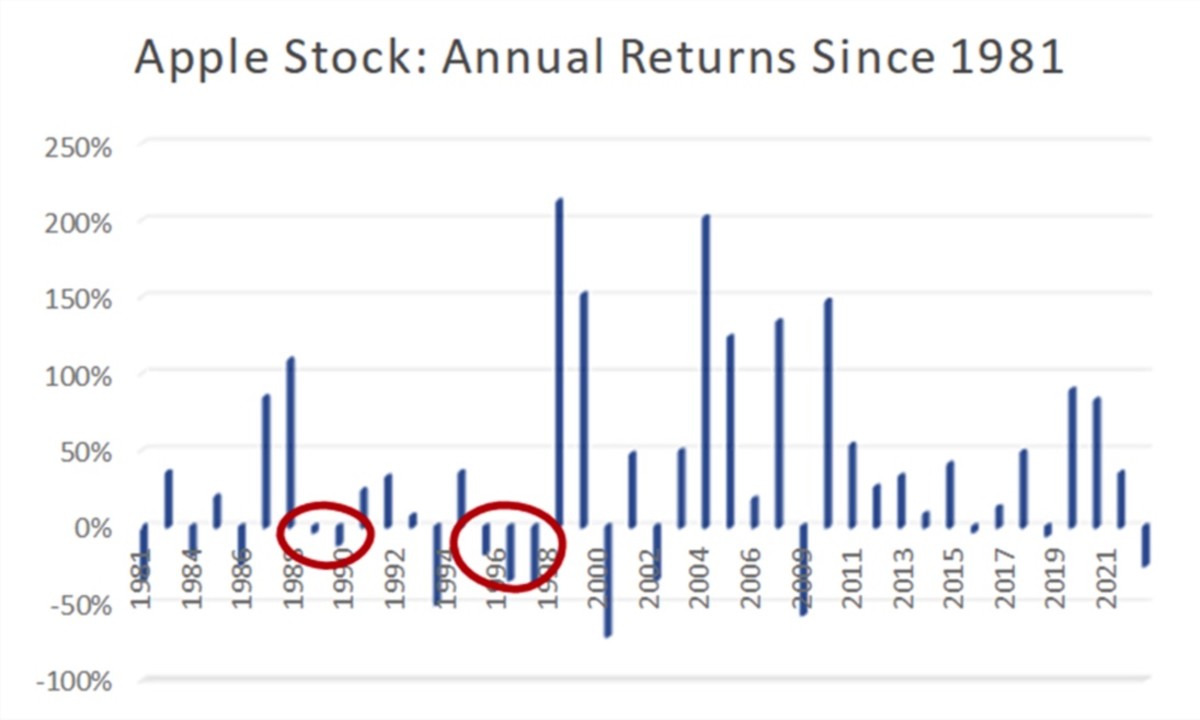

Apple Stock The Street

Based on 32 Wall Street analysts offering 12 month price targets for Apple in the last 3 months. The average price target is $ with a high forecast of. Seller: Dow Jones & Company, Inc., publisher of The Wall Street Journal. ; Size: MB ; Category: Finance ; Compatibility. iPhone: Requires iOS or later. View the latest Apple Inc. (AAPL) stock price, news, historical charts, analyst ratings and financial information from WSJ. Long-term investors in Apple have every right to celebrate – AAPL stock has risen a remarkable % over the past 10 years. Back in January , shares stood. The 30 analysts with month price forecasts for Apple stock have an average target of , with a low estimate of and a high estimate of The. Apple (AAPL) is one of the most popular stocks on Wall Street, as the tech giant is one of the largest companies in the world. Though its stock made quite. View Apple Inc. AAPL stock quote prices, financial information, real-time forecasts, and company news from CNN. Apple's (NASDAQ: AAPL) stock rallied this week after the gadget giant reported stronger-than-expected Q2 results and announced the largest-ever share. Find the latest Apple Inc. (AAPL) stock quote, history, news and other vital information to help you with your stock trading and investing. Based on 32 Wall Street analysts offering 12 month price targets for Apple in the last 3 months. The average price target is $ with a high forecast of. Seller: Dow Jones & Company, Inc., publisher of The Wall Street Journal. ; Size: MB ; Category: Finance ; Compatibility. iPhone: Requires iOS or later. View the latest Apple Inc. (AAPL) stock price, news, historical charts, analyst ratings and financial information from WSJ. Long-term investors in Apple have every right to celebrate – AAPL stock has risen a remarkable % over the past 10 years. Back in January , shares stood. The 30 analysts with month price forecasts for Apple stock have an average target of , with a low estimate of and a high estimate of The. Apple (AAPL) is one of the most popular stocks on Wall Street, as the tech giant is one of the largest companies in the world. Though its stock made quite. View Apple Inc. AAPL stock quote prices, financial information, real-time forecasts, and company news from CNN. Apple's (NASDAQ: AAPL) stock rallied this week after the gadget giant reported stronger-than-expected Q2 results and announced the largest-ever share. Find the latest Apple Inc. (AAPL) stock quote, history, news and other vital information to help you with your stock trading and investing.

Inside Apple Stock: Cash, Value, and a $3 Trillion Valuation. By Kênio Fontes. Dec 15, AM EST.

Apple's (NASDAQ: AAPL) stock rallied this week after the gadget giant reported stronger-than-expected Q2 results and announced the largest-ever share. Discover real-time Apple Inc. Common Stock (AAPL) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. There have been few Apple product releases that immediately resulted in a meteoric rise in the company's stock price. Day traders are known to target Apple at. Historical Earnings Dates (1 Year). Using Wall Street Horizon historical data as a primary data source, independent academic studies have shown that market. Key Data. Open $; Day Range - ; 52 Week Range - ; Market Cap $T; Shares Outstanding B; Public Float B. Wall Street Analysts' Ratings are Pouring in on Apple $AAPL following their iPhone 16 Debut The stock has received mostly Buys. Apple Inc (NASDAQ:AAPL) Intrinsic Valuation. Check if AAPL is Wall Street analysts forecast AAPL stock price to rise over the next 12 months. stock: What is the company's Apple Pay opportunity August 27, AM Street-high target July 15, AM - StreetInsider Apple at all. Track APPLE INC. (AAPL) price, historical values, financial information, price forecast, and insights to empower your investing journey | MSN Money. According to 27 Wall Street analysts that have issued a 1 year AAPL price target, the average AAPL price target is $, with the highest AAPL stock price. Apple Inc. historical stock charts and prices, analyst ratings, financials, and today's real-time AAPL stock price. (NASDAQ: AAPL) Apple stock price per share is $ today (as of Sep 13, ). What is Apple's Market Cap? Starting tomorrow, September 13, at 5 a.m. PDT, customers can pre-order Apple's powerful new iPhone 16 and iPhone 16 Pro models. Stock analysis for Apple Inc (AAPL:NASDAQ GS) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Beyond hardware, Apple provides a suite of services such as the App Store, Apple Music, Apple TV+, and Apple Pay, catering to various digital lifestyle needs. Apple Inc AAPL:NASDAQ ; after hours icon After Hours: Last | 09/13/24 EDT. quote price arrow down (%) ; Volume. 2,, What Stock Exchange Does Apple Trade On? Apple is listed and trades on the NASDAQ stock exchange. What Is the Stock Symbol for Apple? Apple stock surged Monday after receiving a pair of upbeat reports from Wall Street analysts who said the iPhone maker is poised for an upgrade cycle. Dow Jones. Starting tomorrow, September 13, at 5 a.m. PDT, customers can pre-order Apple's powerful new iPhone 16 and iPhone 16 Pro models. Apple (AAPL) is one of the most popular stocks on Wall Street, as the tech giant is one of the largest companies in the world. Though its stock made quite.

Open New Ira Account Bonus

How it works: · Open a new eligible E*TRADE account. · Enter promo code 'REWARD24' when opening the new account. Use promo code REWARD24 only once for one account. A SEP IRA offers higher contribution limits than other retirement accounts. For the tax year, contributions can be up to 25% of compensation, with a. With no account fees and no minimums to open a retail brokerage account, including IRAs Trading fees. Stocks & options, ETFs, Bonds & CDs, Mutual funds. $0. If you're a new employer that came into existence after October 1 of the year, you can establish the SIMPLE IRA plan as soon as administratively feasible after. Don't miss our latest deals and offers, all wrapped up for you to enjoy. See Let's get you started with an account, personalized for you! Open Checking. Member FDIC. New Premier Checking customers can earn a $ bonus. Open a IRAs) and (b) investment account balances (investments available through. Open your IRA online quickly & easily ; Move money directly from your bank to your new Vanguard IRA® electronically. You'll just need your bank account and. Bonus Debit Checking Prepare for your future with our selection of IRA and accounts. Open a New or Service an Existing IRA Account Contact us. A rollover of retirement plan assets to an IRA or transfer of other assets is not your only option. The decision to open an IRA or Janus Henderson account. How it works: · Open a new eligible E*TRADE account. · Enter promo code 'REWARD24' when opening the new account. Use promo code REWARD24 only once for one account. A SEP IRA offers higher contribution limits than other retirement accounts. For the tax year, contributions can be up to 25% of compensation, with a. With no account fees and no minimums to open a retail brokerage account, including IRAs Trading fees. Stocks & options, ETFs, Bonds & CDs, Mutual funds. $0. If you're a new employer that came into existence after October 1 of the year, you can establish the SIMPLE IRA plan as soon as administratively feasible after. Don't miss our latest deals and offers, all wrapped up for you to enjoy. See Let's get you started with an account, personalized for you! Open Checking. Member FDIC. New Premier Checking customers can earn a $ bonus. Open a IRAs) and (b) investment account balances (investments available through. Open your IRA online quickly & easily ; Move money directly from your bank to your new Vanguard IRA® electronically. You'll just need your bank account and. Bonus Debit Checking Prepare for your future with our selection of IRA and accounts. Open a New or Service an Existing IRA Account Contact us. A rollover of retirement plan assets to an IRA or transfer of other assets is not your only option. The decision to open an IRA or Janus Henderson account.

No term, so money can be transferred at any time · $10 minimum opening balance · Contributions can be as low as $10 · Eligible for a preferred pricing rate bonus. Cash promotion is limited to one per customer and can only be applied to one new J.P. Morgan Self-Directed Investing account (General Investment, Traditional. A standard brokerage account, also known as The Fidelity Account, is an eligible account for our $50 for $ bonus offer. To register, you can. You would then need to open another type of investment account. Visit Investing Overview or call (TTY: ) to learn more. When you're referred and become a new Schwab client, you can get up to $1, Simply enroll in the offer and make a qualifying net deposit of cash or. A savings IRA account can help you make the most of your hard-earned retirement. Explore IRA options from Bank of America and open an account online today. IRAs can help you save even if you already have a (k) or other workplace retirement account. Each type of IRA offers advantages before and after you retire. An Eligible Customer who satisfies the Offer Requirements is eligible to receive a “Deposit Bonus” consisting of a payment to their IRA Account. A savings IRA account can help you make the most of your hard-earned retirement. Explore IRA options from Bank of America and open an account online today. What is a Roth IRA? A Roth IRA is an individual retirement account that offers tax-free growth and tax-free withdrawals in retirement. open an account. Which Wells Fargo IRA is right for you? For more information, contact a Wells Fargo Retirement Professional at Individual retirement accounts (IRAs) are accounts specifically set up to use during retirement by offering significant tax advantages. And the sooner you start. An IRA Money Market account offers the advantage of earning competitive rates starting at $1,, helping your retirement savings grow steadily. With its tiered. Regardless of your account balance or how often you trade, you can open an account with a $0 minimum deposit plus get $0 online listed equity trade commissions. 6 Ally is offering cash bonuses for new self-directed trading accounts, including rollovers from a (k).7 The deadline for opening an account is Sept. Select your own investments · No account-opening fees or minimums3—invest with as little as $1 · Choose from a broad range of investment options, including those. Receive up to a $ bonus with required minimum opening deposit (Associated Access Checking: $25, Associated Balanced or Choice Checking: $) and recurring. No minimum balance is required to open a Bonus IRA account or to obtain the disclosed APY. IRA transfers or rollovers from another financial institution or. So if you have your money in a (k) or (b) or another IRA, you can open a traditional IRA with Principal by moving that money directly, with no tax. The cash bonus award will be deposited into the new TDAI Traditional IRA account or new TDAI Roth IRA account and will be treated as earnings on that account.

Average Credit Card Cost Per Month

At the end of each monthly billing cycle, the card issuer will tell you how much you owe, the minimum payment it requires from you, and when that payment is. There is usually a dollar amount for your minimum monthly payment, and it may be written like, "$35 or 2% of your balance plus fees, whichever is greater." Each. The average credit card processing fee, sometimes referred to as a "swipe fee," is %, according to the Merchant Payments Coalition. What is the average credit card interest rate? Get a % introductory interest rate on balance transfers for the first 6 months (% after that; annual fee $39) Annual fee: $ Interest rates: Find Stripe fees and pricing information. Find our processing fees for credit cards monthly. Starting at $ per month, 1-year contract. Subscription. The average credit card interest rate in America today is % — the highest since LendingTree began tracking rates monthly in The average credit card interest rate is % for new offers and % for existing accounts, according to WalletHub's Credit Card Landscape Report. Many credit cards charge a fee every year just for having the card. Annual fees typically range from $95 to upwards of $ At the end of each monthly billing cycle, the card issuer will tell you how much you owe, the minimum payment it requires from you, and when that payment is. There is usually a dollar amount for your minimum monthly payment, and it may be written like, "$35 or 2% of your balance plus fees, whichever is greater." Each. The average credit card processing fee, sometimes referred to as a "swipe fee," is %, according to the Merchant Payments Coalition. What is the average credit card interest rate? Get a % introductory interest rate on balance transfers for the first 6 months (% after that; annual fee $39) Annual fee: $ Interest rates: Find Stripe fees and pricing information. Find our processing fees for credit cards monthly. Starting at $ per month, 1-year contract. Subscription. The average credit card interest rate in America today is % — the highest since LendingTree began tracking rates monthly in The average credit card interest rate is % for new offers and % for existing accounts, according to WalletHub's Credit Card Landscape Report. Many credit cards charge a fee every year just for having the card. Annual fees typically range from $95 to upwards of $

If your credit card charges 20% interest per year and you pay Carrying a credit card balance over from month to month will result in exorbitant costs. per card payment, so you can keep more of what you make. Credit card fees are included in Square's fees, so there are no charges from credit card companies. You can take advantage of this offer when you apply now. Interest Rates & Fees Summary. cost, based on average published rate for Maple Leaf Lounge entry;; $59 cost of additional 5 paid visits costing $35 USD per person, per visit. At. When used responsibly, a credit card can make you money. Other times, it can cost you. Visit Citizens to learn about the costs of using a credit card. A month later, when the credit card provider charges the card owner with the average cash payer to the average card payer per year. Benefits. QuickBooks will cover up to $25, per year—$10, per dispute on card payments.** Process over $2, per month? You could qualify for up to 25% off. Credit card balance ; Interest rate ; How do you plan to payoff? Pay a certain amount. pay per month. or use Interest + 1% of Balance, 2%, 3%, 4%, 5%. The average credit card APR now hovers at 20%, making it more expensive than ever to carry a balance. Photo illustration by Fortune; Original photo by Getty. Credit Card #1. Monthly Payment: $ Credit card balance. On average, credit card processing fees can range between % and %. Fees can be charged per transaction, per month or per year depending on the credit. Credit card debt varies due to age/income/other factors, but only makes up a fraction of personal debt. The average consumer's debt in America is $, The minimum payment is the smallest amount of money that you have to pay each month to keep your account in good standing. By paying it, you'll avoid late fees. These fees vary quite a bit, ranging from $15 to $75 or more. Remember that not all cards charge an annual fee. Annual Percentage Rate: The annual percentage. Typical credit card processing fees range from %% of the total transaction. The exact amount will vary, depending on the: Payment network; Type of. In most cases, credit card processing fees will run between % to 4% of the total value of a transaction. A $1, transaction, therefore, could have fees. Fair and transparent pricing for every way you accept payments — no hidden fees Save time every month with recurring payments. Commercial Banking. Percent except as noted. Commercial bank interest rates. New car loans. month, , , , , Credit card processing fees can often cost from % to % of a total transaction. Here, learn more about how these charges are calculated. Learn more about Wells Fargo merchant services credit card processing fees, and better understand what your small business could pay in a typical month.

How Does A Stock Margin Account Work

:max_bytes(150000):strip_icc()/margin-101-the-dangers-of-buying-stocks-on-margin-356328_V2-3a27513fade64c769d9abce43cec81f7.png)

A margin account is a type of brokerage account that allows customers to borrow and invest in stocks and other types of securities. The broker uses the investor. It helps to start with an overview of how margin accounts work to understand margin rates. Margin accounts allow investors to purchase securities using borrowed. With a margin account, you deposit cash, which serves as the collateral for a loan to purchase securities. You can use this to borrow up to 50% of the purchase. Let's say you purchase stock in a margin account. As the buyer, you pay a portion of the purchase price and the broker lends you the difference. You pay. A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. Trading on margin magnifies gains and losses. How does trading work while in a house call? Clients Before trading stocks in a margin account, you should carefully review the margin agreement. A margin account allows you to borrow money from a brokerage firm to buy securities. This is also the only type of account in which investors can engage in. Margin investing allows you to have more assets available in your account to buy marginable securities. Your buying power consists of your money available to. With a margin account, you can buy a stock (or financial instruments) by borrowing the balance amount funds from a broker. When you borrow this money from a. A margin account is a type of brokerage account that allows customers to borrow and invest in stocks and other types of securities. The broker uses the investor. It helps to start with an overview of how margin accounts work to understand margin rates. Margin accounts allow investors to purchase securities using borrowed. With a margin account, you deposit cash, which serves as the collateral for a loan to purchase securities. You can use this to borrow up to 50% of the purchase. Let's say you purchase stock in a margin account. As the buyer, you pay a portion of the purchase price and the broker lends you the difference. You pay. A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. Trading on margin magnifies gains and losses. How does trading work while in a house call? Clients Before trading stocks in a margin account, you should carefully review the margin agreement. A margin account allows you to borrow money from a brokerage firm to buy securities. This is also the only type of account in which investors can engage in. Margin investing allows you to have more assets available in your account to buy marginable securities. Your buying power consists of your money available to. With a margin account, you can buy a stock (or financial instruments) by borrowing the balance amount funds from a broker. When you borrow this money from a.

A margin type for all traders · Access to a credit line. Margin accounts often come with a built-in credit line that allows investors to tap into additional. Margin accounts at brokerage firms allow investors to use their stock investments as collateral to take out a loan. How to Open Your First Brokerage. Because margin is an extension of credit, you can use your margin loan to purchase additional securities. Increased profit potential thanks to leverage. A. Benefits of a Margin Trading Account · Leverage Assets. Use the cash or securities in your brokerage account as leverage to increase your buying power. · Access. Here's how the margin account works. You have a cash balance and they give you a couple times you cash as buying power. Let's say the account. With a margin account, you can buy a stock (or financial instruments) by borrowing the balance amount funds from a broker. When you borrow this money from a. Buying stocks on margin is essentially borrowing money from your broker to buy securities. That leverages your potential returns, both for the good and the bad. A margin account lets you leverage securities you already own as collateral for a loan to buy additional securities. Here's an example: Suppose you use. How it works · Suppose your account holds $25, of marginable stock and a $14, margin loan. · Then the value of your stock falls to $19, · This would. With a margin account, you can borrow money from your brokerage account to purchase securities. The portion of the purchase price that you must deposit is. If your portfolio is dominated by a large block of stock from one company, such as a current or former employer, you could be putting too many eggs in one. You must deposit at least $2, in cash or generally twice that in fully-paid eligible securities to open a margin account. What you should know before you use. A margin account allows you to borrow from the brokerage to purchase securities that are worth more than the cash you have on hand. Benefits of a Margin Trading Account · Leverage Assets. Use the cash or securities in your brokerage account as leverage to increase your buying power. · Access. For each trade made in a margin account, we use all available cash and sweep funds first and then charge the customer the current margin interest rate on the. A margin account is a type of brokerage account where the broker-dealer lends the investor cash to purchase securities (or use the funds for other short-term. Your account equity in this example would be $2, ($5, investment value minus borrowed amount). Borrow margin example. Once you purchase securities on. The stocks or assets kept in the margin account serve as security for the margin loan. Not all securities, nevertheless, can be bought on margin. Minimum Margin. The trading platforms will use any remaining cash in your margin account before borrowing funds to invest. If you do not have cash available for the full. Buying securities on margin allows you to acquire more shares than you could on a cash-only basis. If the stock price goes up, your earnings are potentially.

When Can I Get A Credit Card After Bankruptcy

You can get a credit card as soon as your bankruptcy is fully discharged. Once the bankruptcy is finalized, you can start exploring options such as secured. Bankruptcy does not erase a bad credit history, but it does give you a second chance. Don't waste it. Demonstrate you've learned a lesson about personal. In most cases, a loan applicant must wait at least two years after the date of his or her bankruptcy discharge, regardless of the chapter of bankruptcy filed. Can you get a credit card after bankruptcy? You can, however, always get new credit cards after filing for bankruptcy. Many of my clients continue to get. After bankruptcy, individuals can improve their credit scores within months by adhering to budgets, making timely payments, and opening new accounts. There are loans and credit cards specifically designed to help you rebuild credit after an event like bankruptcy. Five to six months after the activation of your first credit card, you should apply for another credit card. To achieve the highest scores, people need five to. Gas station and local retail store credit cards are typically easier to get approved for after bankruptcy. Once you have a history of making timely payments. Once you have no debt, as you will after a bankruptcy, plenty of financial institutions will offer you loans and credit cards. Because you are a. You can get a credit card as soon as your bankruptcy is fully discharged. Once the bankruptcy is finalized, you can start exploring options such as secured. Bankruptcy does not erase a bad credit history, but it does give you a second chance. Don't waste it. Demonstrate you've learned a lesson about personal. In most cases, a loan applicant must wait at least two years after the date of his or her bankruptcy discharge, regardless of the chapter of bankruptcy filed. Can you get a credit card after bankruptcy? You can, however, always get new credit cards after filing for bankruptcy. Many of my clients continue to get. After bankruptcy, individuals can improve their credit scores within months by adhering to budgets, making timely payments, and opening new accounts. There are loans and credit cards specifically designed to help you rebuild credit after an event like bankruptcy. Five to six months after the activation of your first credit card, you should apply for another credit card. To achieve the highest scores, people need five to. Gas station and local retail store credit cards are typically easier to get approved for after bankruptcy. Once you have a history of making timely payments. Once you have no debt, as you will after a bankruptcy, plenty of financial institutions will offer you loans and credit cards. Because you are a.

To get a secured credit card, you'll need to save up about $ for the security deposit so that the credit card company can hold that money for up to 2 years. You should first try a smaller financial institution and apply for a low-limit credit card. Shortly after a bankruptcy, you might need to get a secured credit. A common question during bankruptcy is whether an individual can continue to use their credit card(s) when they file for bankruptcy. · While you can still use. Once your bankruptcy is finalized you can get a credit card. Just make sure that the card meets your needs and will help you rebuild your credit rating under. You can in fact get a credit card once the bankruptcy is completed. There are also other options you may want to explore that won't require opening a line of. Most of our clients receive a number of credit card offers shortly after their discharge. This is because a debtor can only receive a Chapter 7 discharge once. My bankruptcy just discharged and I want to get a card to build my credit back up but should I do it right away? I heard secured cards are. In Canada, a first bankruptcy will stay on your credit report for years. During this time your credit score will likely be at the lowest possible level. You can typically apply for a credit card after your bankruptcy has been discharged, which is usually three to six months after filing for bankruptcy. However. If you've filed for bankruptcy, applying for a secured credit card can be an impactful way to start rebuilding your credit score, especially since there are. They are willing to do this as soon as you are discharged, because your credit limit is secured by your cash deposit. This works for credit repair after. Fortunately, most banks are willing to give you a secured credit card even if you are bankrupt. As the name indicates, an asset of some kind backs up a secured. This means the secured creditor can't sue you after a bankruptcy to collect The things you buy with the credit card may be collateral. The store. Obtaining a traditional unsecured credit card might be difficult immediately after bankruptcy. Secured credit cards can be a great option to rebuild your credit. Exceptions An exception would be a 3rd party card (such as a company expense account card). In that case, the Trustee needs to have a letter on file from the. In the typical successful Chapter 7 bankruptcy filing, your credit card debt, along with other unsecured consumer debts like medical costs, could receive a. After your bankruptcy has ended, there is no restriction on applying for loans or credit. It's up to the credit provider to decide if they will lend you money. One of the ways to rebuild credit after bankruptcy is through secured credit cards. A secured credit card is backed by a cash deposit you make upfront, with the. Gas station and local retail store credit cards are typically easier to get approved for after bankruptcy. Once you have a history of making timely payments.

1 2 3 4 5